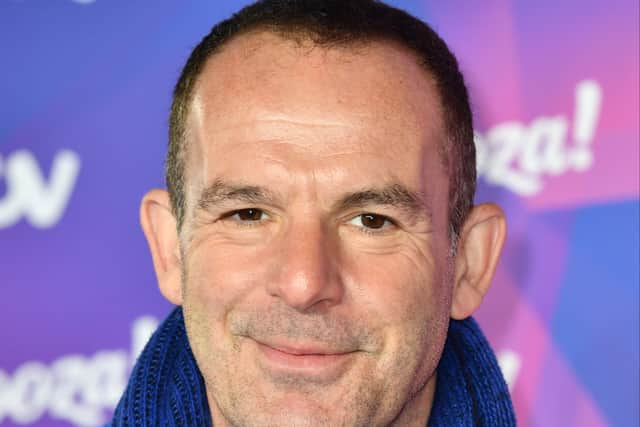

Martin Lewis calls Government mini-budget “a staggering statement” as Kwasi Kwarteng announces tax cuts & more

and live on Freeview channel 276

Martin Lewis has expressed scepticism after the Government laid out plans to boost the economy in a mini-budget statement this morning.

Voicing his opinion through a series of Tweets, the finance guru branded the changes "a staggering statement from a Conservative Party government".

Advertisement

Hide AdAdvertisement

Hide AdUnder the new leadership of Liz Truss, Chancellor Kwasi Kwarteng outlined a series of tax cuts and other economic measures, including cutting the basic rate of income tax to 19p and abolishing the 45% top rate of tax for higher earners.

A scheduled increase in National Insurance has also been reversed.

How Martin Lewis responded to budget statement

Mr Lewis, founder of the Money Saving Expert website, commented on a number of the announcements made today.

On the abolishment of the top rate of income tax, he said: “From next April the 45% top rate of tax (applies to those earning £150,000) will be scrapped. So the top rate will be the 40% higher rate threshold.

Advertisement

Hide AdAdvertisement

Hide Ad“This means mega earners pay the same rate as those on £50,000.”

On moves to simplify the tax system across the board, he welcomed the idea, but questioned whether it could be achieved.

"The Office of Tax simplification will be wound down, and ‘all officials will be charged with simplifying taxes’," he said.

"Tax simplification is absolutely desired. Unfortunately I question whether any party can deliver on it. Rules tend to morph and move rather than get simple."

Advertisement

Hide AdAdvertisement

Hide AdAnd on the overall statement, Mr Lewis said he was ‘confused’ at the Government’s seeming wish to distance itself from Boris Johnson’s changes, while at the same time being proud of its achievements.

"Isn’t this a new era, being distanced from the "highest tax rates since 1940s" administration?," he asked.

"Or is it claim ‘good’ bits, disown ‘bad’?"

Other changes in today’s announcement include the stamp duty threshold in England and Northern Ireland raised to £250,000 or £425,000 for first-time buyers.

In addition to this, the cap on bankers’ bonuses has been lifted, and a planned rise in corporation tax has also been scrapped.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.